Managing a real estate portfolio from a sustainable perspective may seem difficult to put into practice: we know that the goal is to achieve zero emissions by 2050 to comply with the 2050 Agenda, but... Where to start?

First of all, we must understand that sustainability must be considered from all areas of action of a company or organization, especially in those whose professional activities have a direct impact on greenhouse gas emissions and the environment.

The owners of real estate portfolios are an example of a company that should especially ensure compliance with environmental regulations and even go beyond, as their management and maintenance directly impact the use of natural resources and energy use, which translates into carbon emissions.

Furthermore, sustainability as a transversal axis in a company's operations is also shared in the ESG vision, whose criteria define a company model adapted to the current social, environmental and economic context.

Carbon footprint of real estate portfolios

The essential information we need for the sustainable management of a real estate portfolio is to know the carbon emissions of all the buildings in a portfolio, i.e. their carbon footprint. To obtain this data we carried out a Life Cycle Analysis (LCA).

The LCA allows us to identify at which stage of the construction, use, or material of a building more greenhouse gas emissions are generated. Thanks to this data, we can focus on the areas that generate the most emissions and select better material options for their construction and maintenance.

Therefore, in order to manage a real estate portfolio in a sustainable way, we will need to know the carbon footprint of each of the buildings that make it up, so that we can analyse all the data together, establish comparisons and obtain a global vision.

It is important to note that not only companies involved in the ownership of real estate portfolios should assess their carbon footprint, but every company should quantify the carbon footprint derived from its business activity, i.e. its corporate carbon foot print.

The ESG perspective

The ESG criteria have become a fundamental framework for evaluating and promoting sustainability in the business and financial sectors. When it comes to managing real estate portfolios, it is essential to carry out sustainable management that takes into account the environmental criteria of ESG.

This perspective not only drives long-term profitability in a company but also contributes to building a more equitable, resilient, and environmentally harmonious real estate environment.

5 steps to evaluate the environmental impact of a real estate portfolio

Managing real estate portfolios with a sustainable perspective may seem like a broad and difficult idea to pin down. At Zero Consulting, we have a methodology that allows us to focus on reducing emissions throughout the life cycle of each project, not only at the building level but also at the real estate portfolio level.

Managing real estate portfolios with a sustainable perspective may seem like a broad and difficult idea to pin down. At Zero Consulting, we have a methodology that allows us to focus on reducing emissions throughout the life cycle of each project, not only at the building level but also at the real estate portfolio level.

This means collecting all LCA data from the buildings owned by a company and analysing them together.

Analysing emissions data as a whole will give an overall picture of the environmental impact of the portfolio, allow comparisons between projects and define a benchmark or reference point from which to start and improve year on year.

This holistic perspective helps us develop more effective sustainability strategies and make informed decisions about real estate portfolio management.

Let's look at the 5 steps to globally analyse a real estate portfolio in terms of sustainability.

1. Define the KPIs or key performance indicators

The first step in making a sustainable analysis of a property portfolio is to define the Key Performance Indicators or KPIs that we want to quantify, as they will allow us to evaluate and measure the performance and sustainability of our property portfolio. Choosing the most suitable KPIs will depend on the company's objectives and the characteristics of its professional activity.

Some of the most commonly used and useful general KPIs for a sustainable analysis of a real estate portfolio are:

- Average Kg CO2 per m² usable floor area over 50 years

- Average Kg of CO2 per occupant over 50 years

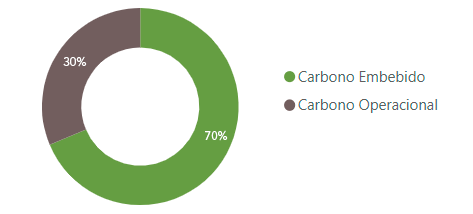

- Balance of embodied and operational carbon: corresponds to the percentage of emissions that correspond to embodied carbon (emissions associated with construction materials and their life cycle) and operational carbon (emissions generated during the use phase and operation of the building, related to energy use and water).

Embodied and Operational Carbon Balance

In addition to general KPIs, we can set specific indicators for operational and embodied carbon in buildings to help us understand what the total emissions are, for example:

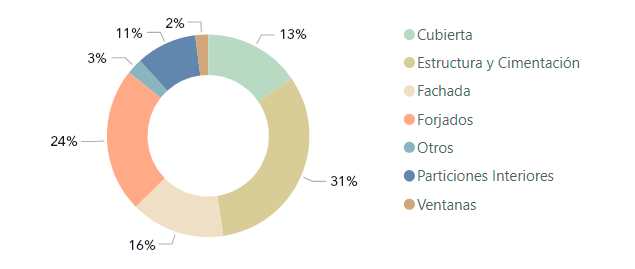

- Embodied carbon balance: it allows us to know the percentage of emissions that correspond to each group of constructive elements.

Embodied Carbon Balance

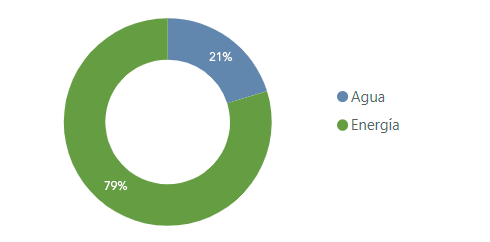

- Operational carbon balance: percentage of emissions are from the maintenance and use of the buildings, i.e. their water and energy use.

Operational Carbon Balance

In short, having Key Performance Indicators provides us with a global and quantified view of the environmental impact of a real estate portfolio, allowing us to make informed decisions and design effective strategies to achieve sustainable management.

2. Calculation of emissions from construction elements

One of the main areas to be analysed is the materials used in building construction. In order to carry out the analysis, it is advisable to divide the constructive elements or constructive solutions into groups (roofs, facades, slabs, interior partitions, windows) to be able to analyse their materials in detail.

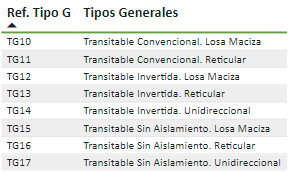

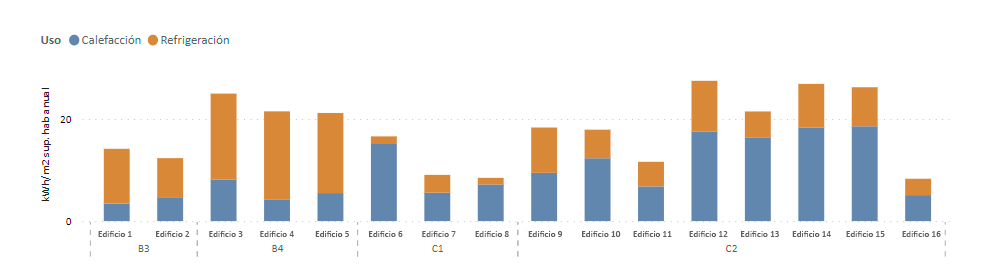

For example, the roof of a building can be of different types, as we can see in the table on the right. Each type of roof is made up of a range of materials, corresponding to different emissions. This is why we have different levels of categorisation, not only for roofs but for all groups of construction elements.

For example, the roof of a building can be of different types, as we can see in the table on the right. Each type of roof is made up of a range of materials, corresponding to different emissions. This is why we have different levels of categorisation, not only for roofs but for all groups of construction elements.

The following chart analyses the materials that make up the roofs of 32 buildings, grouped by the type of roof used. In this way, we can compare all the roofs used in this real estate portfolio, as well as see whether they meet the company's emissions target. In this way, for the following building promotions, decisions can be made about the type of roof to use, taking into account the emissions of other buildings.

Constructive roofing solutions

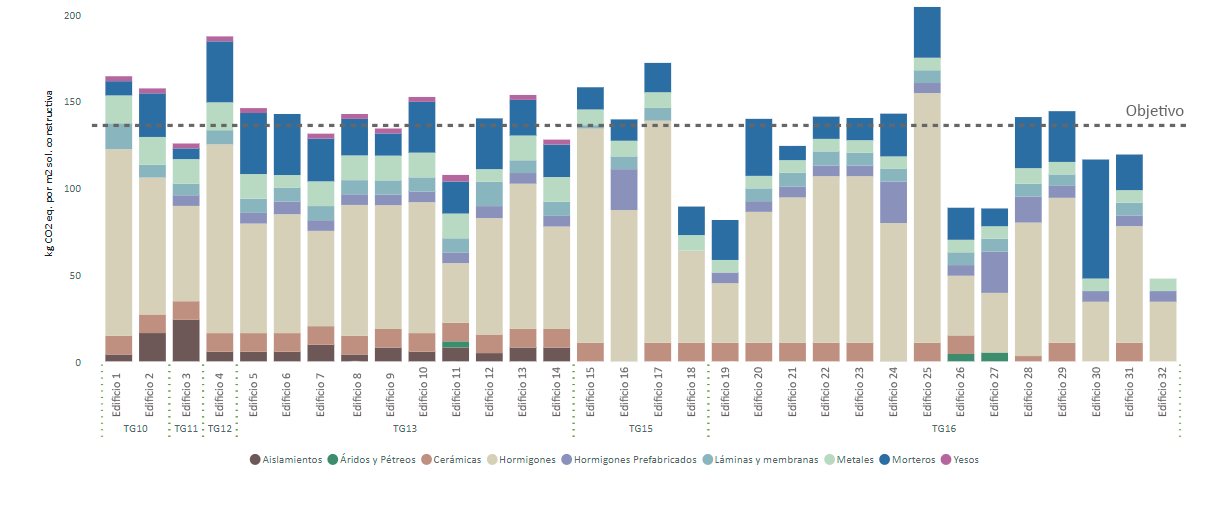

On the other hand, it is also interesting to analyse by types of construction detail. That is, to obtain an average value of each type of construction detail for all types of roofs, facades, floors, interior partitions, and windows that have been used in all the buildings that are part of the portfolio.

For example, this graph shows the weighted average of emissions by types of roofs used in projects, taking into account the surface area they represent in the buildings. We can see that the type of roof that has resulted in the most CO2 emissions in this real estate portfolio is the TG11 type, that is, the walkable inverted solid slab.

Weighted average of kg of CO2 eq. per m2 of construction detail of roofs

3. Energy Emissions Calculation

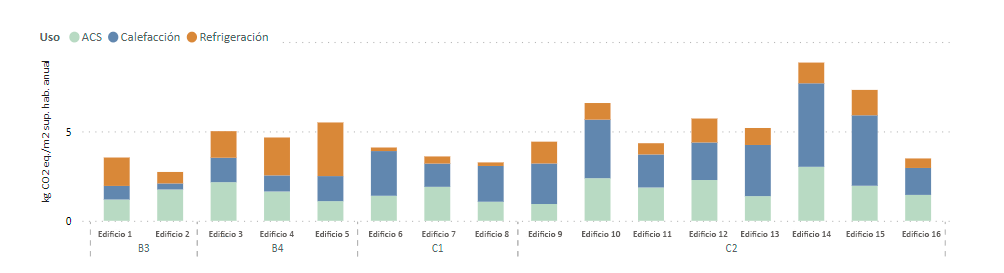

The next area to analyse is the emissions derived from energy. We divide energy emissions into 3 different uses: heating, cooling, and domestic hot water (DHW).

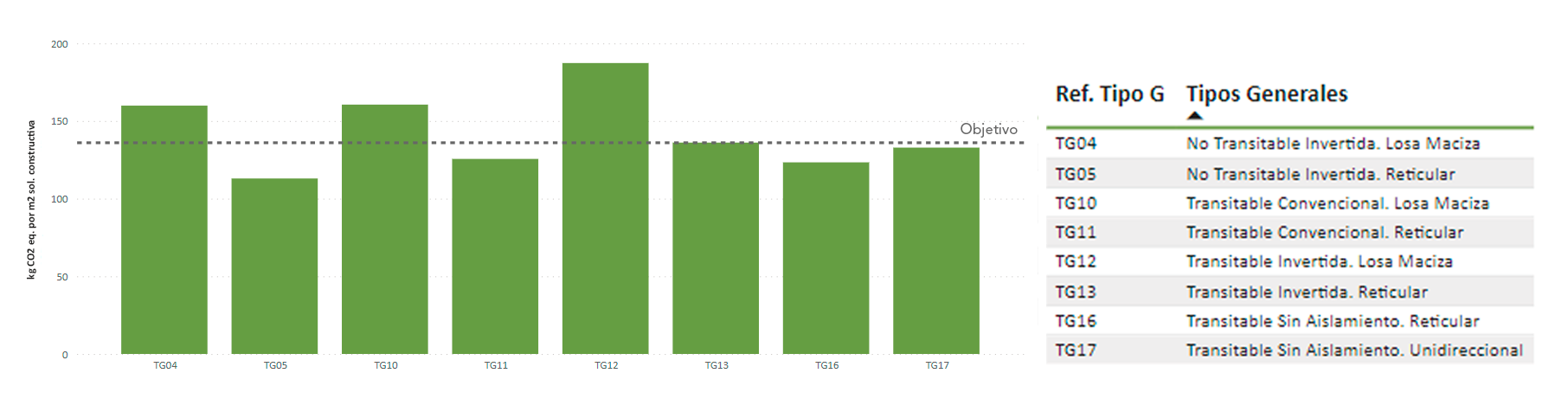

In the case of emissions from energy use, it is interesting to classify buildings according to the climate zone in which they are located, as this is a factor that influences their energy demand.

Thanks to the following two graphs, we can compare the energy demand of each of the buildings in a real estate portfolio, grouped by climate zones. We can compare the demand with the final CO2 emissions of the buildings, thus seeing what percentage of emissions derive from each type of energy use.

Demand

CO2 eq. emissions

If, for example, we focus only on emissions from heating energy, we can also check the type of energy that has been used in each of the buildings in the portfolio (electricity or natural gas) to meet the demand.

Energies used in each project

4. Calculation of emissions derived from water

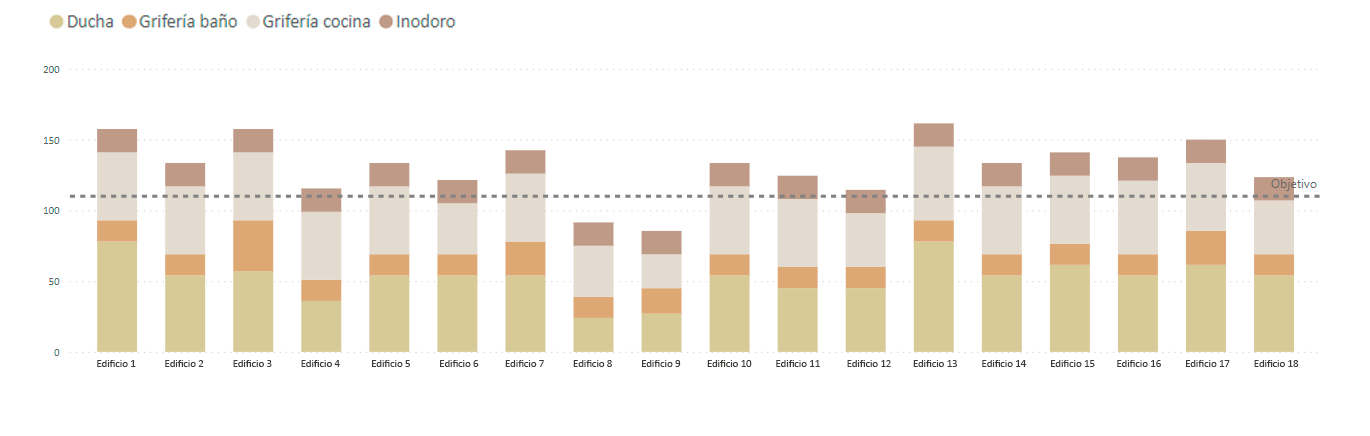

The last major area from which emissions must be analysed are those that derive from water use. That is to say, depending on the type of faucet, shower, toilet installed or irrigation and the occupancy of the building, it will result in a higher or lower volume of emissions.

The following chart compares the water consumption per person per day, which varies depending on the type of sanitary elements used. As we can see, most projects exceed the target set by the company, so for future projects, the option of installing more efficient sanitary elements should be considered.

Water consumption per litres per person per day

5. Extract quantified conclusions and establish a decarbonisation pathway

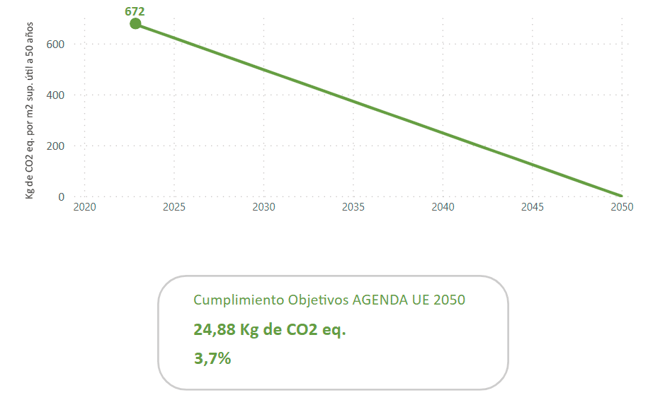

The final step is to take a global view and draw conclusions to help us understand the overall environmental impact of all the buildings in the portfolio, determining future steps to reduce their carbon footprint.

A key element in determining the medium- and long-term reduction strategy is to draw up a decarbonisation roadmap. Through this graphical representation, we can calculate the level of emission reduction needed each year until 2050 to achieve the targets set by the 2050 Agenda, that is, zero emissions.

Annual Reduction Targets (per m² of usable area over 50 years)

In this case, the emissions per m² usable floor area over 50 years are 672 kg CO2, which means that in order to achieve zero emissions in 2050, a 3.7% reduction in emissions has to be made each year, which corresponds to a reduction of 24.88 kg CO2 per year.

It is worth mentioning that not only is the Agenda 2050 indicator set as the only reference target to be met, but each company can choose to set more ambitious environmental objectives than those set by existing regulations.

How can we help you?

Managing real estate portfolios from a sustainable perspective is essential to meet the European decarbonisation targets necessary to address current environmental issues. This implies implementing changes in the traditional way of building, opting for more sustainable alternatives.

Zero Consulting can help you develop an effective decarbonisation strategy, not only at the building level, but also at the portfolio level. Our strategies are based on decision-making from the earliest stages of projects, in order to efficiently influence the environmental impact derived from the construction of buildings. Additionally, we ensure compliance with relevant regulations, such as the European Taxonomy regulation.