The Global Real Estate Sustainability Benchmark (GRESB) has recently positioned itself as one of the most widely used tools for assessing and improving the environmental, social and governance (ESG) performance of real estate portfolios worldwide.

In this article, we delve into this evaluation framework, its methodology, and its importance in the field of sustainable investment. We will also see its close relationship with the European Taxonomy and the integration of ESG criteria.

As we know, the integration of sustainability into investment decision-making has gained momentum in recent years. This is due to the growing recognition of environmental and social challenges, along with investor demand for responsible investment practices. In this context, GRESB has emerged as a way to assess and compare results in terms of responsibility for real estate portfolios and large asset management.

What is GRESB? Methodology and evaluation criteria

The GRESB was established in 2009 to assess the sustainability performance of real estate and infrastructure portfolios worldwide. It provides a standardized and international framework to evaluate various aspects of ESG performance, allowing investors to compare the sustainability performance of different entities within the real estate sector.

In this assessment, qualitative and quantitative aspects of sustainability performance are covered. Participants must report relevant data and information about their portfolios, which are evaluated based on a series of comprehensive evaluation criteria. These criteria include, among others, energy efficiency measures, carbon emission reduction strategies, water conservation initiatives, sustainable building certifications, stakeholder engagement practices, and governance structures.

The objective of GRESB is to provide business intelligence, engagement tools, and regulatory reporting solutions for investors, asset managers, and the industry at large. They achieve this through the collection, validation, qualification, and comparison of data. Additionally, GRESB aligns with the Sustainable Development Goals (SDGs), the Paris Agreement, and the main international frameworks for sustainable reporting.

Each year, GRESB publishes global benchmarking data showing the state of ESG in the industry. The benchmark evolves over time, ensuring that the scores reflect evolving sustainability performance and expectations. In the last section of the article, we will see the main results of the sustainable asset study in 2023.

The importance of GRESB in sustainable real estate investment

GRESB plays a key role in driving sustainability improvements in the real estate sector, encouraging transparency, accountability and performance improvement. For real estate investors, GRESB provides valuable information on the sustainability performance of their portfolios, allowing them to identify areas for improvement and make informed investment decisions.

Additionally, GRESB scores serve as a benchmark to evaluate and compare the sustainability performance of various real estate funds and companies, thereby facilitating market transparency and accountability.

How does it integrate with Taxonomy EU and ESG criteria?

The European Taxonomy Regulation establishes a classification system for environmentally sustainable economic activities. The EU Taxonomy aims to provide investors with a common framework for identifying sustainable investments and aligning capital flows with EU climate objectives. In the context of real estate investment, the EU Taxonomy has significant implications, as it establishes clear criteria for determining the environmental sustainability of real estate assets and projects.

Moreover, the integration of ESG criteria has become increasingly important in real estate investment decision-making, driven by regulatory requirements and investor demand. GRESB provides a framework for assessing and comparing the ESG performance of real estate portfolios, allowing investors to incorporate ESG considerations into their investment strategies.

GRESB Real Estate Assessment 2023 Results

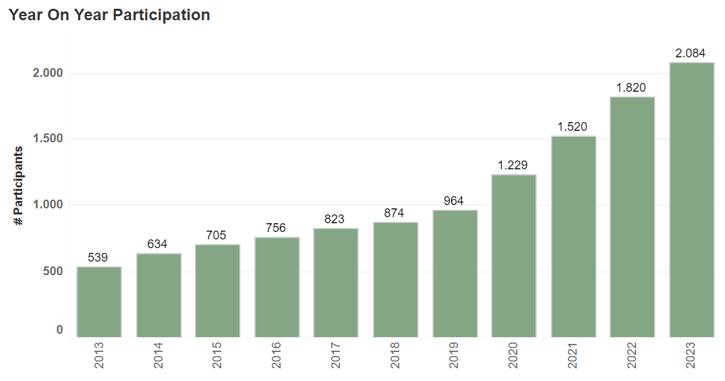

A total of 2084 companies participated in the GRESB Real Estate Assessment 2023 results report, covering approximately 170,000 real estate assets globally. In the context of Spain, 22 companies contributed to the results report.

As shown in the graph below, participation in the study has been increasing year after year, reflecting a growing commitment from companies in the sector.

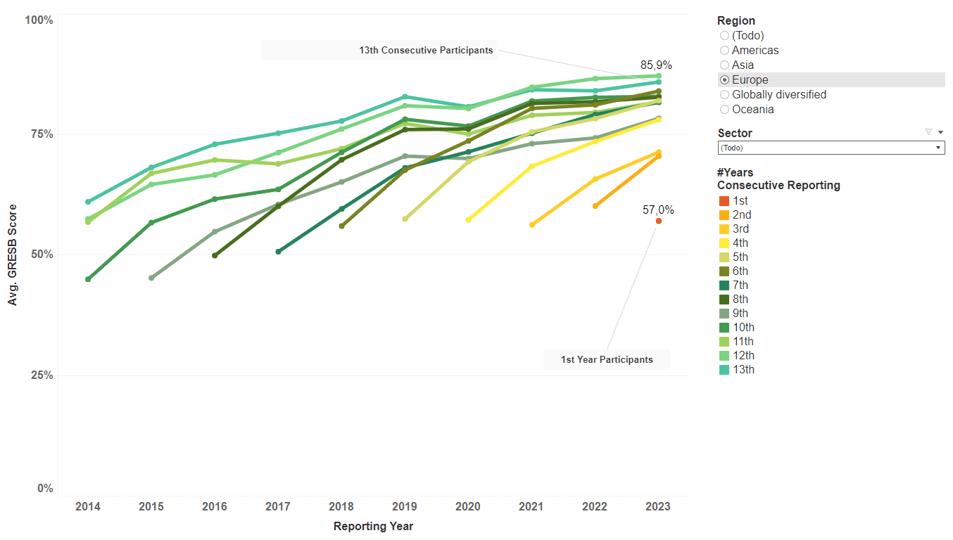

An analysis of the evolution of the scores shows an upward trend as participating companies continue to incorporate the practices and standards suggested by GRESB.

The scores are divided into three broad groups: development, management and performance, which allows for a more precise classification of companies' performance areas. When observing the average score in the development area over the last three years at the European level, the aspects in which companies obtain lower scores are identified, providing a clear roadmap to improve commitment to the environment and society. Interestingly, these average scores have been increasing year-on-year, suggesting the implementation of actions to strengthen sustainability in the sector.

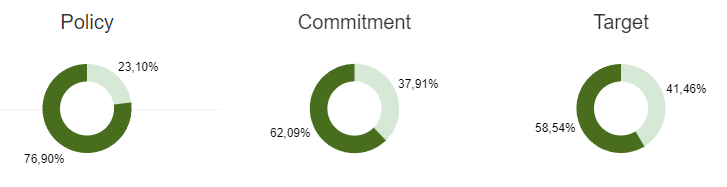

GRESB also assesses gender diversity in the sector, as well as the carbon emission reduction targets of companies and organisations. For example, regarding net-zero emissions targets, 76% of the participating companies have taken action, while 62% have made a public commitment and 58% have set specific targets in this regard.

As we can see, 76% of the companies participating in the study have taken measures to achieve net-zero emissions targets, although 62% of the total have made a public commitment and 58% have set a net emissions target.

We remind you that the full report is available on the GRESB website. In the interactive report, it can be segregated by region, by sector, and by other interesting variables to analyse.

We can conclude with the idea that GRESB is a very powerful tool when it comes to evaluating the sustainable performance of real estate portfolios. At Zero Consulting, we can help you define a short and long-term strategy to decarbonise your asset portfolio. You can get in touch with us and

The full report is available on the GRESB website, where you can access the interactive report that allows segmentation by region, sector and other relevant variables for a detailed analysis.

In summary, GRESB emerges as a powerful tool for assessing the sustainable performance of real estate portfolios, providing a solid foundation for formulating short- and long-term strategies for the decarbonisation of assets. At Zero Consulting, we are committed to assisting in this process, so remember to contact us to explore how we can help you define your sustainable strategy.