The real estate sector plays a crucial role in the decarbonisation efforts to comply with the European Green Pact and achieve a carbon-neutral continent by 2050, as it is one of the sectors that generates the highest greenhouse gas emissions.

In this context, the CRREM tool (Carbon Risk Real Estate Monitor) is a solution that allows companies to assess and manage the devaluation risks associated with the level of sustainability of their real estate assets.

Risk of devaluation in the real estate sector

One of the main challenges of the existing real estate stock in Spain is its low energy efficiency due to its ageing. The average Spanish energy rating is in the letter E, which leads to an increase in emissions derived from the operational consumption of buildings, since those with low energy efficiency consume more energy in their daily operation.

While it is true that new construction buildings must be energy efficient, such as nZEB or near-zero energy buildings, we cannot overlook the efficiency problem of the existing real estate stock. The energy retrofitting of buildings in Spain is an initiative supported by European funds, specifically the Next Generation funds.

This problem of low energy efficiency directly affects property owners and investors who have a portfolio of assets or properties to manage. This is because a building with low energy efficiency leads to higher operational consumption emissions and also implies higher maintenance costs. Consequently, real estate assets depreciate if they are not energy efficient or do not adapt to new sustainable policies. CRREM refers to this type of assets as stranded or obsolete assets.

What is the CRREM tool?

CRREM (Carbon Risk Real Estate Monitor) is a global tool designed to effectively address the financial risks associated with poor energy efficiency in the real estate sector. Its main objective is to provide companies in the sector with a science-based guide to reduce carbon emissions and tools to assess the financial risks that could lead to a loss of value of their assets.

CRREM (Carbon Risk Real Estate Monitor) is a global tool designed to effectively address the financial risks associated with poor energy efficiency in the real estate sector. Its main objective is to provide companies in the sector with a science-based guide to reduce carbon emissions and tools to assess the financial risks that could lead to a loss of value of their assets.

It is important to note that the tool focuses on operational emissions (from the use and maintenance of the building), not on embodied emissions (associated with construction materials and their life cycle).

Through the use of CRREM, companies in the real estate sector can establish a clear and effective roadmap to improve the energy efficiency of their assets, reduce greenhouse gas emissions, and mitigate associated financial risks.

The CRREM tool provides a series of key benefits that help understand and address the challenges of the real estate sector:

- Identification of the most relevant carbon reduction measures: allows companies and investors to identify and prioritise the most effective actions to reduce carbon emissions according to their characteristics and needs.

- Asset and portfolio risk assessment: provides a rigorous assessment of the risk exposure of real estate assets, especially in relation to carbon stranded asset risk. The CRREM indicates the time before an asset or portfolio is affected by this type of risk.

- Alignment with future policies: The CRREM tool allows the alignment of implemented renovations and measures with policies and regulations. It also provides us with both the economic and energy benefits of each rehabilitation done to an asset.

According to CRREM, the real estate sector is 14 years behind: at the current rate of emissions, the amount of carbon available by 2050 will be consumed by 2036. For this reason, it is necessary to start applying decarbonisation measures in the sector effectively and imminently.

CRREM decarbonisation methodology

With the aim of providing a clear and effective roadmap, CRREM has developed a methodological approach that enables companies to assess, plan and implement decarbonisation measures in their real estate assets.

In order to understand how CRREM works, it is important to first understand a number of key aspects of the tool, which are explained below.

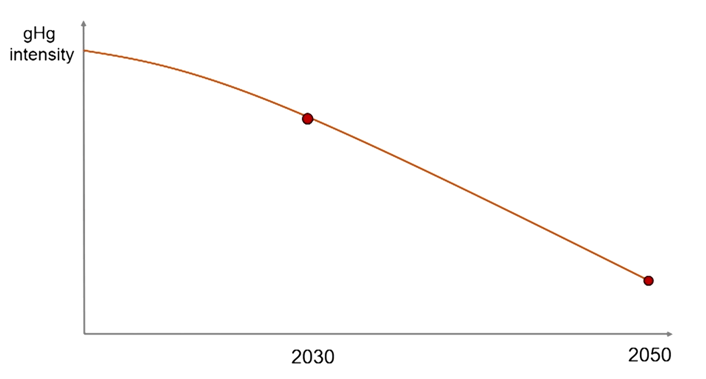

The European policy pathway

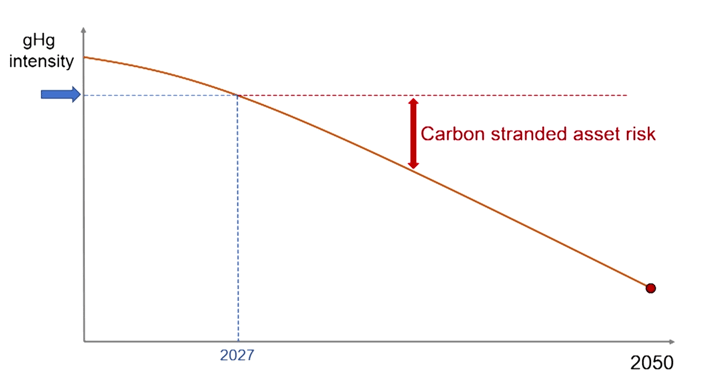

The starting point for the CRREM tool is to define the emission reduction pathway set out in the European guidelines. To this end, we have a graph that shows the intensity of greenhouse gases on the vertical axis (i.e., the volume of emissions) and time on the horizontal axis, with 2050 as the maximum horizon.

The CRREM sets the total value of carbon emissions that should be achieved by 2050 and 2030, which are those defined in European policies and regulations (specifically, the Paris Agreement). Having this information, the tool traces the decarbonisation route that the assets or portfolio must follow, marked by an orange line in the following graph.

Graph of the decarbonisation pathway outlined by the Paris Agreement

Graph of the decarbonisation pathway outlined by the Paris Agreement

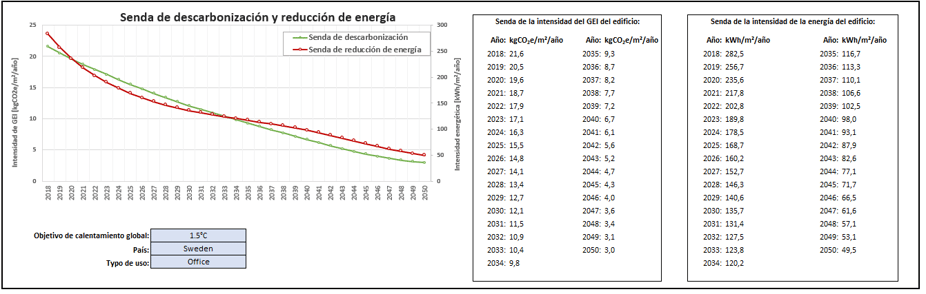

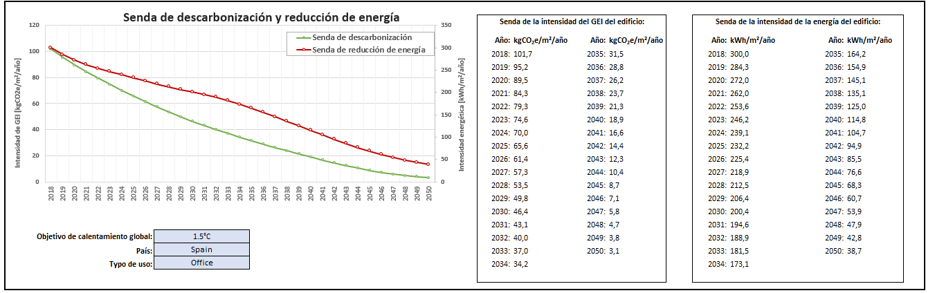

These parameters allow quantifying the level of decarbonisation needed each year from the present until 2050 to achieve the desired goal. Moreover, the CRREM adapts these values to the type of property and the country of the European Union in which they are located. Therefore, the decarbonisation pathway is not the same for an office building located in Spain as it is for an office building in Sweden, as we can see in the two graphs below. In the same way, the different types of buildings (offices, hospitals, hotels, etc.) are not analysed in the same way.

Comparison between emission reduction values for offices in Sweden (above) and Spain (below)

Carbon stranded asset risk (carbon stranded asset risk)

Once we have marked the policy pathway, the CRREM will help us to determine the level of greenhouse gas intensity of our asset portfolio or a specific property.

By incorporating the specific issues of the asset or portfolio we want to study, the CRREM calculator allows us to identify in which year the crossover with the policy pathway or route marked by European policies, which we have just discussed, will take place. In other words, it will determine from which year onwards our asset or portfolio of assets will be affected by the risk of carbon obsolescence and will be devalued if decarbonisation measures are not implemented.

Next, we can see the same graph that we have shown previously with the new information introduced. In this example, the blue arrow indicates the level of greenhouse gas emissions of a given portfolio.

Real Estate Asset Obsolescence Risk Chart

Real Estate Asset Obsolescence Risk Chart

As can be seen in the graph, in 2027 this asset portfolio will reach the policy pathway. Therefore, if the owner of this asset portfolio does not take action, from 2027 onwards he will face what is known as carbon stranded asset risk, which corresponds to the risk of devaluation of a property or portfolio.

Therefore, if our asset portfolio reaches this point, it will no longer be aligned with the decarbonisation policies established by the European Union and will lose economic value, in addition to potentially facing regulatory compliance issues.

Implementation of energy retrofitting

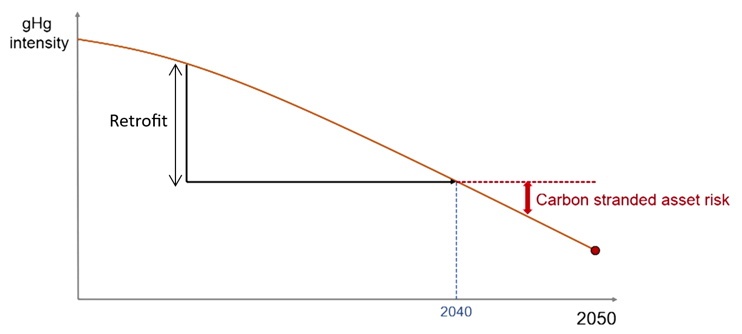

CRREM recommends reducing the carbon emissions of a given portfolio or property before reaching the point where carbon stranded asset risk begins. In this case, CRREM calculates how this risk can be delayed through the application of energy retrofitting.

Graph that incorporates energy retrofitting which delays the risk of carbon-stranded assets

Graph that incorporates energy retrofitting which delays the risk of carbon-stranded assets

In this case, the portfolio we are taking as an example would still face the risk of stranded carbon assets after a retrofit in 2027, but would be delayed until 2040.

The CRREM, in addition to determining how much the devaluation of a portfolio can be delayed if decarbonisation measures are applied, also calculates the economic and energy benefit of implementing such measures.

Science Based Targets

The basis for CRREM's work and calculations is Science Based Targets . These targets are quantified in kgCO2e/m² and represent how the CRREM translates the global concept of the Paris Agreement to an asset or portfolio owner scale.

The following process allows for determining these science-based objectives:

- Calculation of the share of projected global emissions for 2050 attributable to the European Union according to the Paris Agreement.

- Assignment of specific real estate objectives for each country taking into account the Paris Agreement.

- Calculation of specific carbon reduction targets for each type of building (offices, hospitals, hotels, commercial, warehouse, etc.) based on the target of the country in which it is located.

Based on these concrete targets, CRREM creates a roadmap or framework for how long the owner has before being affected by the risk of carbon stranded assets and how the measures applied to reduce the intensity of carbon emissions (retrofit) affect him energetically, but also economically, as mentioned in the previous section.

How is the CRREM used?

The tool can be downloaded for free from the CRREM website, in a version without data or a version with sample data included. It consists of a spreadsheet with several tabs or sheets for each functionality of the tool.

Once the settings have been established and the type of buildings to be analysed, the country in which they are located and the environmental objective to be pursued have been chosen, we will proceed to incorporate the consumption data of the buildings, other information about them, budgets, etc. The tool's user manual explains in detail what information should be included in the CRREM.

CRREM will provide us with results both at the asset level and at the portfolio level. In this way, we will be able to make a complete assessment of both the obsolescence risk of our individual assets and our portfolio.

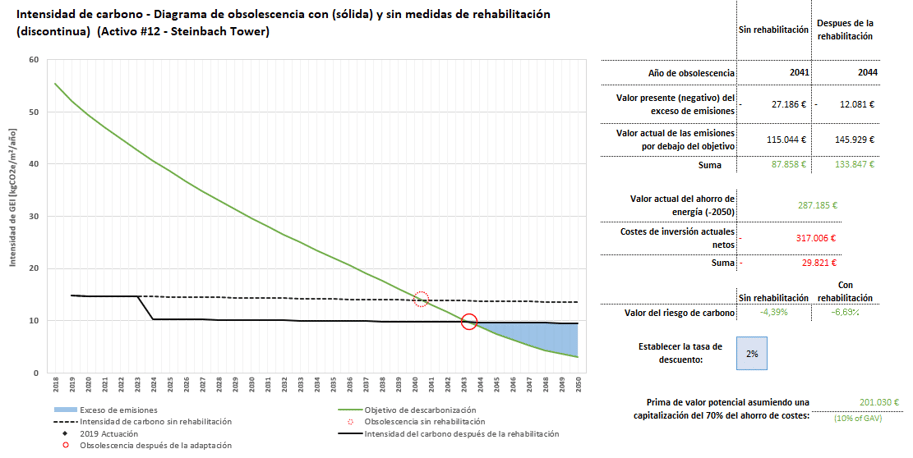

Results at the asset level

In the section of the CRREM called "Assets" we can find a complete analysis differentiated by each of the assets for which we have incorporated information. Among other generated graphics, we can highlight the obsolescence diagram with and without rehabilitation measures. This chart will allow us to quantify the risk derived from applying or not applying decarbonisation measures to our property.

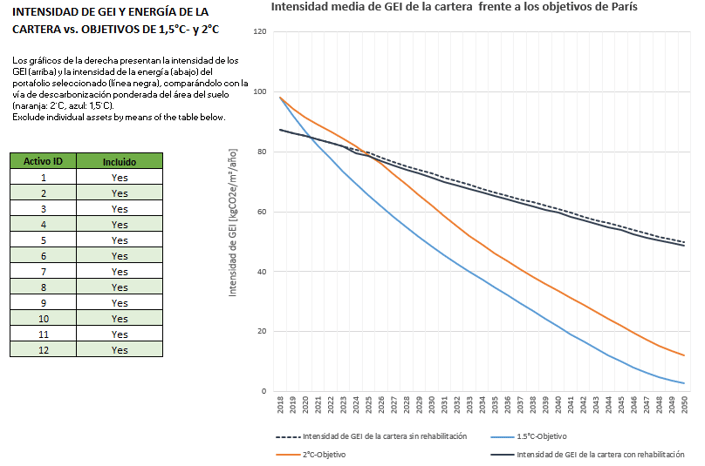

Portfolio-level results

In the "Portfolio" section of the CRREM tool, we can analyse our asset portfolio as a whole. The obtaining of these results allows real estate investors to produce reports on the carbon risk of their portfolios.

One of the graphs generated by this section of the CRREM is the greenhouse gas (GHG) emissions intensity of our portfolio, comparing it with the decarbonisation trajectories weighted by area.

The CRREM portfolio assessment also allows for the analysis of the impact of selling individual properties at a given time. Users can select the year in which they wish to sell a specific asset, which excludes that asset from further considerations. Additionally, information is provided on the reduction costs and the investments needed to meet the decarbonisation targets.

Compliance with ESG criteria

The CRREM approach goes beyond solely addressing the financial risks associated with poor energy efficiency in the real estate sector, and can be a key tool for meeting ESG (environmental, social and governance) criteria.

In particular, CRREM has a close relationship with the European Taxonomy regulation. This regulation establishes the criteria for determining which economic activities are environmentally sustainable and contribute to the EU's climate and environmental objectives.

By applying the CRREM methodology, companies in the real estate sector can measure and quantify the environmental performance of their assets in relation to the criteria of the Taxonomy. This allows them to make more informed investment decisions and direct their efforts towards projects and properties that are considered sustainable according to established standards.

In conclusion, in a global context where climate change mitigation has become a priority, tools such as CRREM play a key role in the assessment and management of carbon risk in the real estate sector. Their science-based approach, the use of targets aligned with international commitments, and the integration of specific charts provide investors with a clear and precise view of the risks related to greenhouse gas emissions.